The Role of Access in Selling Your House

Once you’ve made the decision to sell your house and have hired a real estate agent to help, they’ll ask how much access to your home you want to give potential buyers. Your answer matters more now than it did in recent years. Here’s why.

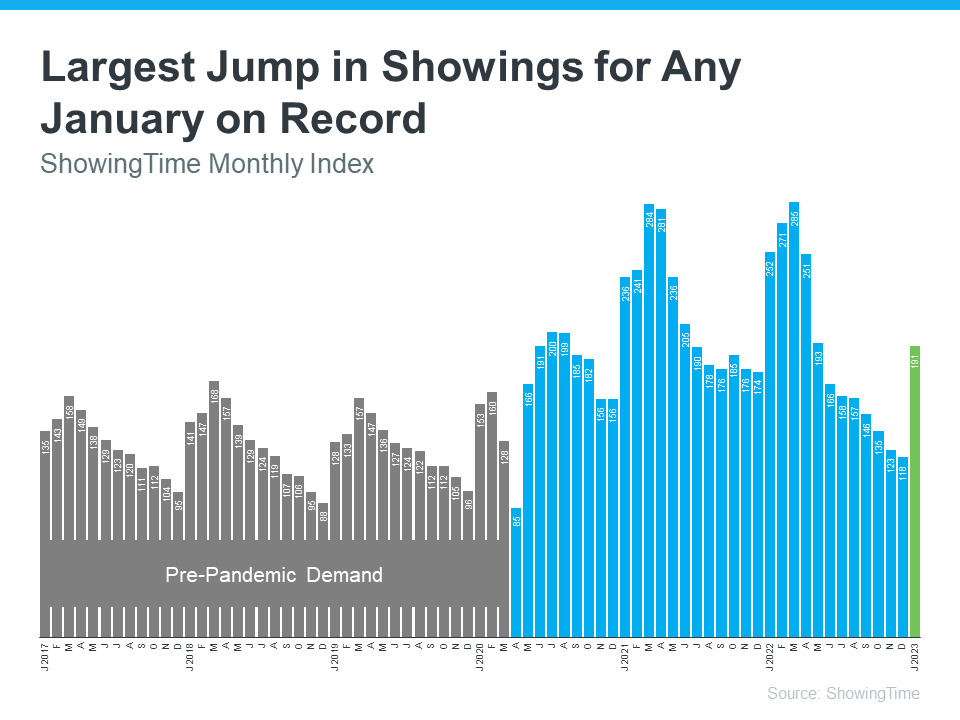

At the height of the buying frenzy seen during the pandemic, there was a rise in the number of homebuyers who put offers on houses sight unseen. That happened for three reasons:

- Extremely low housing inventory

- A lot of competition from other buyers wanting to take advantage of historically low mortgage rates

- And general wariness of in-person home tours during a pandemic

Today, the market’s changing, and buyers can usually be more selective and take more time to explore their options.

So, in order to show your house and sell it efficiently, you’ll want to provide buyers with as much access as you can. Before letting your agent know what works for you, consider these five levels of access you can provide. They’re ordered from most convenient for a buyer to least convenient. Remember, your agent will be better able to sell your house if you provide as much access to buyers as possible.

- Lockbox on the Door – This allows buyers the ability to see the home as soon as they are aware of the listing or at their convenience.

- Providing a Key to the Home – This would require an agent to stop by an office to pick up the key, which is still pretty convenient for a buyer.

- Open Access with a Phone Call – This means you allow a showing with just a phone call’s notice.

- By Appointment Only – For example, you might want your agent to set up a showing at a particular time and give you advance notice. That way you can prepare the house and be sure you have somewhere else you can go in the meantime.

- Limited Access – This might mean you’re only willing to have your house available on certain days or at certain times of day. In general, this is the most difficult and least flexible way to show your house to potential buyers.

As today’s housing market changes, be sure to work with your local agent to give buyers as much access as you can to your house when you sell.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

![Buying a Home May Make More Sense Than Renting [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2023/03/09112231/Buying-A-Home-May-Make-More-Sense-Than-Renting-MEM-1046x2938.png)